To be more realistic in these models, one can admit leakage’s and other factor- such as unemployed resources, market imperfections, and expectations- that may mintage or enhance the basic impacts described above. Introducing greater sophistication increases the complexity and number of variables that must be considered in reaching any conclusion, but it does not make reaching a conclusion any easier. In fact, the results can be less determinant. The amount of unemployment in the economy affects the extent to which changes in aggregate demand move output or prices. In developing economies with limited factor mobility among sectors, the question of unemployed resources may have to be considered on a sectoral as well as an aggregate level, or by skill level. Depending on the particular model used, the inclusion of expectation function private investors will apply to any government action or nonaction. In some cases, where governments have announced a commitment to protect exchange rates or fix interest rates, guesswork is reduced for the market, but possibly at the cost of offering privat speculative investors a largely covered bet. In other cases it is much harder to predict whether a policy course outlined by a government will be seen as credible. In factor in a policy’s effectiveness. The history of government commitment and the market’s estimation of the resources the government has available to defend a position figure into this equation. Although models provide useful general guidance and help frame the issues, their implementation must be tempered by an analysis of the features of practical considerations.

The basic dilemma stems from the role of the exchange rate (nominal for-term transactions and real for long-term decisions) in equilibrating both goods and capital markets as they become more open. Heretofore, developing countries in East Asia and elsewhere have been able to use the level and movement of the exchange rate to effect the goods market almost exclusively. East Asian countries have often used nominal deprecations to maintain stable or slightly falling real exchange rates and so promote exports.

As capital markets open capital flows can create pressures to appreciate the real or nominal exchange rate against targets directed toward the goods market. Attempts to maintain a rate satisfactory for the goods market without adjusting other policy instruments can lead to disruptive capital flows. Either the exchange rate target has to be modified, or other policy instruments must be adjusted. Using the exchange rate as a “nominal anchor” to help combat inflation adds to the burden and can be effective only where fiscal and monetary policies are closely coordinated in support of that objective. In countries with less developed financial sectors, the choice and range of instruments are limited.

As the theoretical models have become richer and more complex, so have the range and complexity world. Most of the stabilization models deal with money and simple bonds as assets and include little, if any, explicit analysis of risk- except as the degree of substitutability of domestic and foreign assets may be taken as a partial proxy for differing risk. The models do not look at the differential impacts of different types of capital flow can be quite different. Policymakers need to look at the characteristics of the instruments involves in capital movements in both a short-term and a medium-term perspective to help formulate policy.

Commercial bank borrowing provides resources that are essentially untied. Where the capital flow is directly linked to a specific project, its impact will be in the capital goods markets. It will probably have a high import content, witch will absorb a portion of the increase in demand from the capital inflow and ease pressure to appreciate the exchange rate or raise domestic prices. However, because these flows are flexible, they can readily be used to finance budget shortfalls of the government or of enterprises, perhaps delaying necessary fundamental adjustment, as often happened leading up to the debt crisis of the 1980s. In that case they increase aggregate demand and are more likely to lead to inflationary pressure and exchange rate appreciation. Because of its fixed term, the stock of this form of capital is not likely to be volatile. However, flows can stop abruptly, leading to economic stresses, particulary where borrowers have come to rely on foreign flows and have allowed domestic savings to decline. Excessive dependence on commercial bank flows can be risky because there are few built-in hedges to protect the borrower against exchange and interest rate fluctuations. Furthermore, repayment schedules are fixed in foreign exchange, and provision must be made to service this debt on schedule, regardless of the state of the economy of then project financed.

Foreign direct investment initially affects the market for real assets through purchases of new capital goods and construction services for plant constructions and sales of firms to foreign investors, or, in the case of privatization’s and sales of firms to foreign investors, through purchases of existing plant and equipment. Direct investors may even encourage incremental national saving and investment, either from local partners or from bank borrowing. FDI in new plant increases the aggregate demand for investment goods, and frequently of other goods as well. Higher demand for imports eases the pressure of capital inflow on the domestic, reduces reserve accumulation, and relieves pressure on the exchange rate. Most FDI in East Asia has been of this productive type, and its impact has been manageable. When FDI is in a protected industry, as has occurred in some cases, the profits it earns may not come from real (as opposed to accounting) value added. This form of FDI is least beneficial, as it exploits local marker imperfections to the advantage of the foreign investor and may not increase domestic value added or measured or wealth measured in world prices. The eventual repatriation of capital and profits could reduce the host real income and wealth.

FDI attracted by privatization programs is not as likely to result in much new investment. (Depending on the terms of sale, the new owner may be required to undertake a certain amount of new investment or renovate existing equipment). When an existing domestic asset is sold, there is no direct increase in the capital stock, although the productivity of the existing capital should increase. FDI received is available for whatever purpose the seller chooses, including reducing an external gap, lowering taxes, or sustaining other current expenditures. The effect depends other current expenditures. The effect depends on what the seller (the government, in the case of privatization, or a private, in the case of a private asset sale to foreign interests) does with the proceeds: reduce other debt (which might ease pressure in the banking system), invest in another project (which would increase investment, as discussed above), or spend on other goods, primary consumption (which would increase aggregate demand and perhaps imports, with no increase in output capacity). To the extent that capital inflows support increased imports without a corresponding increase in investment, domestic saving are reduced.

FDI lows are as sustainable as the underlying attraction- stable policies and profitable opportunities. To the extent that an economy’s growth depends on a sustained inflow of FDI- for the level of investment, for technology and skill transfer, or for supporting an export strategy- the importance of maintaining those conditions is evident. Although FDI is not readily reversible, sharp drops on new flows can have repercussions if countries depend on it for future export growth. Similarly, to the extent that countries have increased resources derived from the foreign investment, a reduction in those flows will require perhaps difficult adjustments on the consumption front.

No contractual repayments are associates with FDI. Investors expect a return on their investment- generally a higher rate of return that on loans and bonds because of the higher risks and opportunity costs involved. Malaysia, which has been the beneficiary of substantial FDI, has grown rapidly: an estimated one- third of its current account receipts is now claimed by service payments on FDI. When FDI flows are sustained over a long period, foreigners inevitably came to own a substantial portion of the country’s capital stock in the sectors that attracted FDI. This prospect is not viewed with as much concern as it once was FDI is not likely to be volatile: once invested, the real asset is not going to more, although changes in ownership are possible. Eventually, a foreign investor may want to sell to a local partner or divest onto a local stock market, and the host country needs to be prepared for a repatriation of capital. In times of stress, however, investor may well find ways to get their capital out quickly. Many investors set as a target the recouping of their outlays (which are usually less than total project cost) within two or three years, through repatriated) profits.

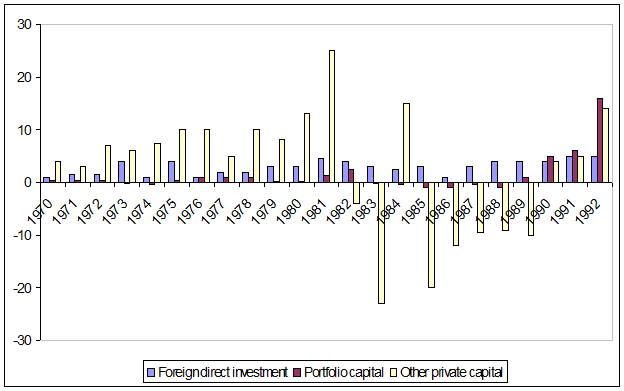

|

Composition of Net Private Capital Flows (in billions of 1985 U.S. dollars)

FPI potentially has a much wider range of effects, depending on the type of instrument and how it is used. It can occur through securities placed in foreign or domestic markets, including short-term funds and demand deposits. (The relation of these two instruments to physical investment may be limited; they may be much more a function of financial variables). Although many of its impacts can be similar to those of bank loans and FDI, portfolio investment can also have a much greater effect on domestic capital markets and interest rates. Whereas direct investment regimes, portfolio flows raise issues of financial and capital market regimes and their management. Portfolio investment touches more on issues of disclosure, accounting, and auditing that does direct investment.

When portfolio investment takes the form of an external placement (bond or equity) and the funds are used to finance new investment, the effects are in the real sector, as discussed for FDI. If the funds are used for other purposes, the result depends on those purposes. Paying down debt might ease pressure in the banking sector or build reserves. If the inflow is subsequently invested in domestic capital markets or deposited in banks, the money supply and domestic credit expand. Demand for assets, including real estate, would probably increase, with effects similar to those of foreign investment in local markets (discussed below). If the funds are used for consumption, pressure on domestic output could increase, leading to a rise in prices. These uses are likely to put more upward pressure on the exchange rate and downward pressure on interest rates, as the prices of nontradables and domestic assets are bid up. This is true whether the government or the private sector carries out the initial borrowing or stock issue. Offshore placement do not give rise to volatility concerns in the issuing country’s market. Subsequent trading in the asset occurs in the foreign market and does not result in further capital movements, other than normal repayments, into or out of the borrowing country. Sustained access to foreign markets if another matter; if depends on the market’s continued positive assessment of the borrower, the liquidity of the borrower’s paper, and the borrower’s compliance with market rules. If circumstances lead to price volatility in foreign markets, new placements will be inhibited.

In some East Asian countries (Indonesia, Korea, and Thailand) domestic banks have been major issuers of bonds into external markets. Since 1990, 40 percent of placements have been by financial institutions, with banks accounting for 27 percent. Large banks obviously have better credit rating than many of their clients and are thus able to raise funds less expensively. This is a legitimate intermediation function and has opened financing opportunities to many domestic firms that would otherwise have had less access to funds. For the ultimate borrower, lower interest rates, not foreign exchange rates, are typically the critical factor. For the intermediating banks, the spreads and volumes are attractive, and the operations help establish the bank’s international presence. These actions, however, pose two risks. First, there may be a relative decrease in the effectiveness of monetary police, since in the effectiveness of monetary policy, since the financial system can miligate or offset government attempts to expand or contract credit by modulating its foreign borrowing for domestic clients. When foreign interest rates are lower than domestic rates, borrowers will be tempted to seek more funds abroad, which may undermine domestic policies of monetary restraint. Second, banks (especially public or quasi-public banks) may be borrowing abroad with the implicit or explicit expectation of a government quartette. They may not take full account of the exchange risk and may face interest risks as well, since they are intermediating across currencies and between short-term liabilities and long-term assets. These risks are likely to be passed on to the government, should they adversely affect the banks. The recently reported instance of BAPINDO, a troubled Indonesian bank that borrowed internatinally, seems to have involved an implicit guarantee, as that bank would not have been able to borrow on its own account. More generally, central banks may be forces to intervene to protect the banking sector with official reserves if there are major disruptions of commercial banks’ capacity to refinance abroad. For some large borrowers, domestic markets may not yet be deep enough to absorb the size and other requirements of their financing needs, so that these enterprises must turn to international markets.

FPI in domestic markets is a different matter. The bulk of this inflow has been in equities, as investors have been seeking high yields, mostly through appreciation. These flows purchase existing portfolio assets and sometimes new issues. To the extent that the new issues fund new investment, the effects would be quite similar would be owned by the domestic issuer rather than the foreign investor. New issues may also be used to recapitalize existing operations. Here the effect would be through the banking system and the rest of the domestic financial market, where debt would be retired by the new equity-generated flows. Although this could ease pressure on the banking system, it would tend to lower interest

9-09-2015, 01:39